Welcome To Dasankop & Associates

Experience, Integrity, and Trust

Our Mission

To offer disciplined, values-aligned wealth management through smart technology and outstanding service that supports our clients’ financial goals while growing and preserving wealth.

At Dasankop and associates, we believe that investing should reflect more than just numbers — it should reflect principles. Our approach is rooted in integrity, transparency, and long-term value creation. We focus on responsible strategies that align with our clients’ goals and values while maintaining a disciplined, risk-aware investment philosophy.

We partner with individuals, families, and institutions to deliver customized solutions that promote financial growth through ethical and thoughtful decision-making. Whether you're planning for tomorrow or building for generations ahead, we’re here to guide you with clarity, purpose, and trust.

Ethical Investing

Based on Shariah principles, our investment philosophy focuses on ethical, transparent, and responsible financial practices. We avoid interest-based and speculative ventures, emphasizing asset-backed investments that align with values of fairness, integrity, and social impact.

We offer a comprehensive suite of investment portfolios designed to provide a systematic approach that can assist you achieving financial success.

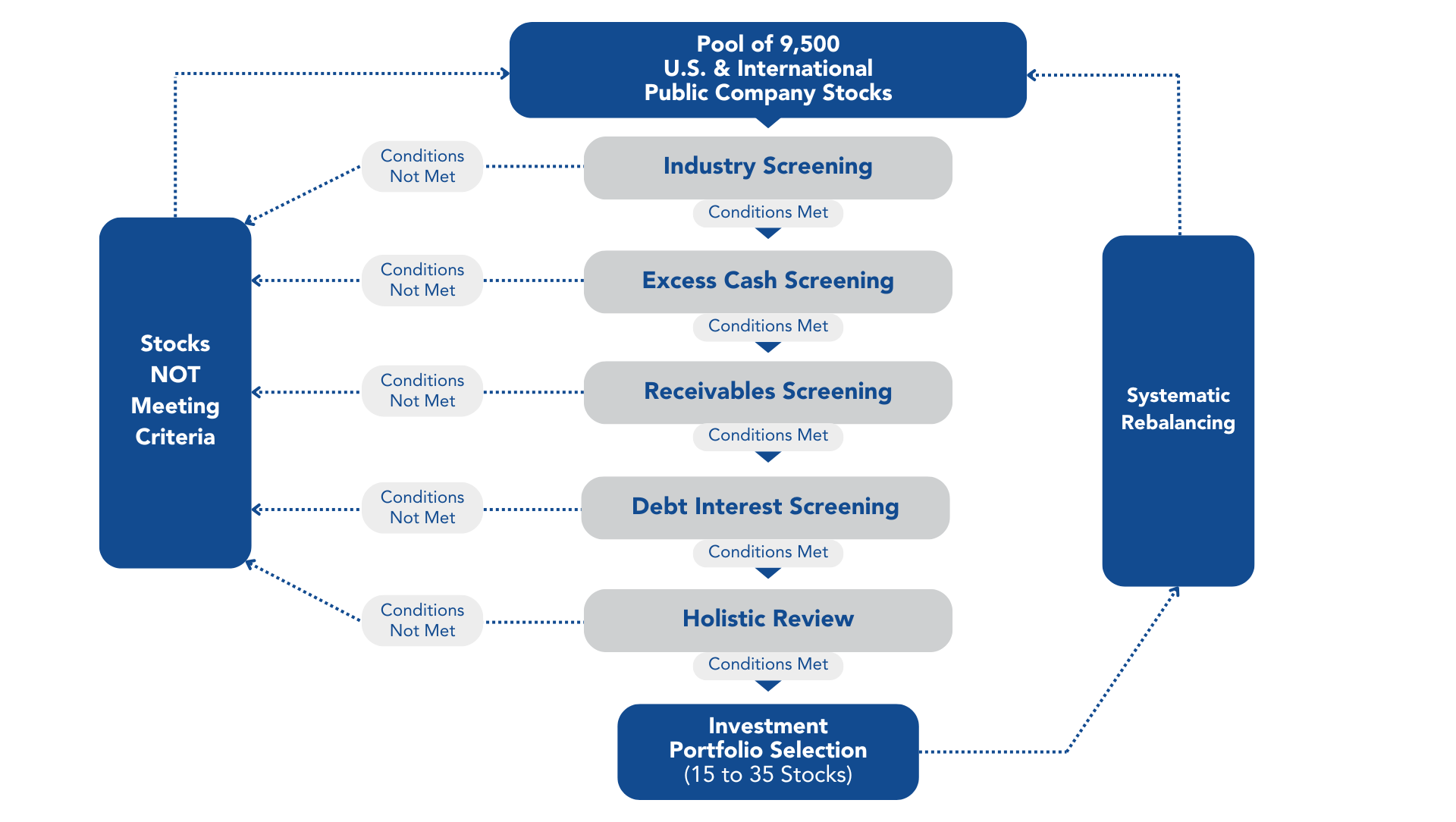

Shariah Investment Process

Our Shariah criteria are developed by identifying similarities across several different Islamic advisory boards.

Sector-Based Screens

Accounting/Financial-Based Screens

- For a company to be included in the portfolio, the following ratio must be

- Less than 33% - Total debt divided by trailing 12-month average market capitalization

- Less than 33% - The sum of the company’s cash and interest-bearing securities divided by trailing 12-month average market capitalization

- Less than 45% - Accounts receivables divided by trailing 12-month average market capitalization

- Less than 5% - Revenue from Haram sources

We use technology to screen and monitor a pool of US and international stocks.

Hallmarks of our Model